Pay Per Mile Car Insurance: The Good, the Bad, and the Unknown

Pay per mile car insurance is a hot-button issue right now. After all, during the COVID-19 pandemic, most people are driving significantly less than they did before. Auto insurance companies have acknowledged this fact by offering a one-time discount off your premium for fewer miles driven in April, May, and now June…

But what if your individual car insurance rate was always based on your actual mileage?

For example: let’s say your neighbor commutes 30 miles into Boston every weekday, racking up at least 1,200 miles per month. You work from home, which means you only drive about 200 miles every month. All else being equal, shouldn’t your car insurance cost much, much less than his?

Lots of people agree with this idea, including a few insurance companies now offering something called “pay per mile car insurance.”

What is pay per mile car insurance?

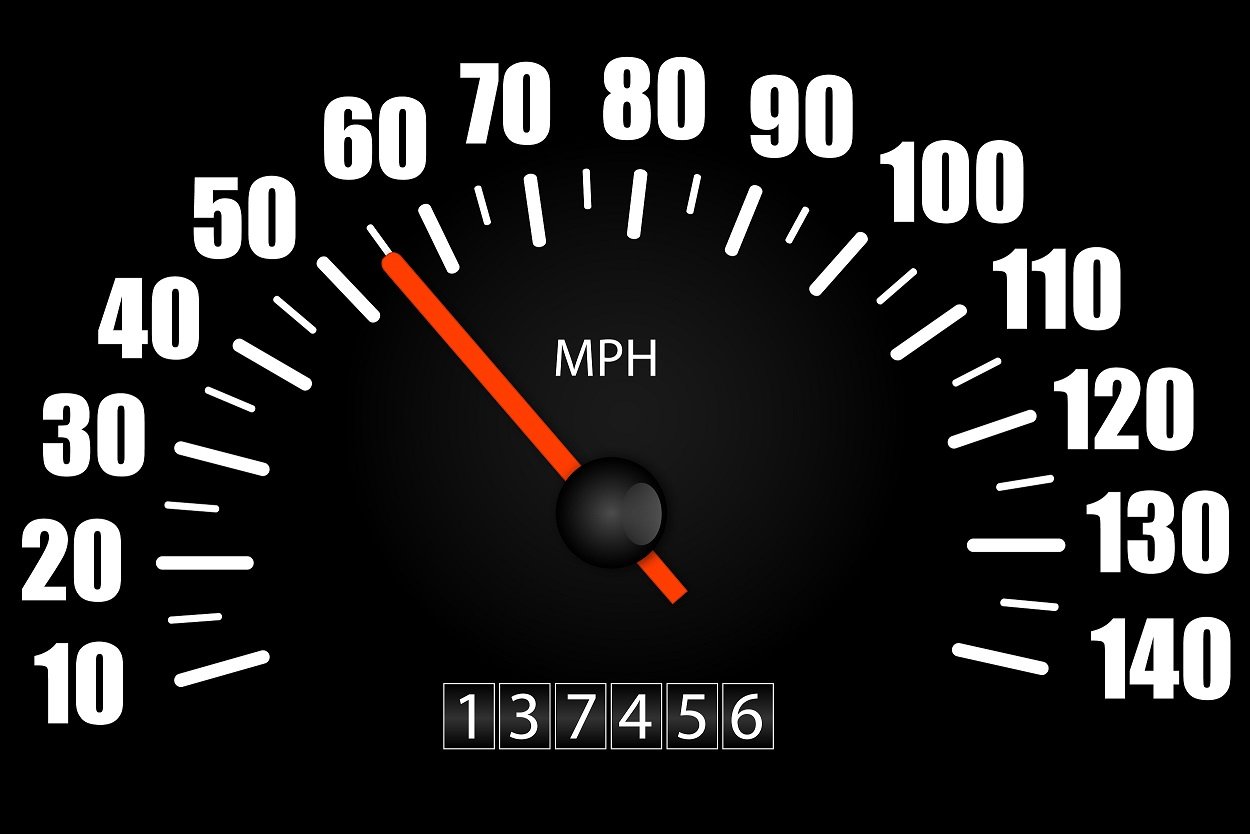

Pay-per-mile car insurance is a type of policy designed to benefit low mileage drivers. Policy holders usually pay a base rate, plus a few cents per mile driven each month. Most PPM policies come with a daily cap (i.e. all miles are free after 250 in one day), so you don’t get slapped with a huge charge if you take an occasional road trip. Miles driven each month are measured via a device that plugs into your dashboard or through a photo app that captures the reading on your odometer. Only a handful of carriers offer this type of policy. Some carriers include safe-driving behavior measures into their calculation of individualized rates.

What are the benefits of pay per mile car insurance?

According to the Federal Highway Administration, the average American driver travels about 13,000 miles per year—or a little over 1,000 miles per month. Teens and senior citizens drive significantly less. And it stands to reason that those who work from home or take advantage of public transportation are also at a much lower tally. For these folks, key PPM benefits include:

- An opportunity to lower your monthly car insurance payment

- A clear measure of how much you drive—an important piece of awareness as we work to protect the environment

What are the downsides of pay per mile car insurance?

If your monthly mileage is somewhere closer to that 1,000 miles/month figure (or even if it’s not), there are good reasons to steer clear of PPM. Potential downsides include:

- After calculating your base rate (which takes into account your driving record, age, etc.) and your typical mileage, you may not actually save any money.

- Not every car insurance carrier offers this option.

- Switching to a company that DOES offer PPM might block you from important coverages or better discounts you are already getting (i.e. by bundling your home or renter’s insurance).

- Switching to an agent that represents this coverage probably means switching to a “direct writer” or a “captive agent,” which in turn means losing access to an independent agent (a true client advocate and a valuable source of knowledge about local laws and insurance requirements.)

- Switching to a direct or captive agent also limits your ability to shop multiple carriers. So, if your premium increases at renewal, you have nowhere else to go. For more on this important point, check out: Do I Need an Insurance Agent?

Can I get pay per mile insurance in Massachusetts?

Maybe. One of the main providers of PPM coverage (Metromile) is not authorized to write policies for Massachusetts drivers. But other companies do offer policies via captive agents. We recommend shopping a variety of options before committing to any new policy.

Where can I learn more about pay per mile car insurance?

Although our partner insurance carriers (click the link to explore our full list) do not currently offer pay per mile options, our agents—all of them MA car insurance experts—are still an ideal source of information about coverage options in the Bay State. We are happy to review whatever coverage you have right now, and compare it against other options. We are also here to explain some of the details consumers tend to overlook when comparing today’s best car insurance rates. These details can add up to big numbers if you are ever involved in an accident or need to file a claim. Call 508.339.2951 to connect with our team!