For Cannabis-Related Businesses in Massachusetts and Throughout New England

Learn more about Weeding Through Operational Risks in the Cannabis Industry.

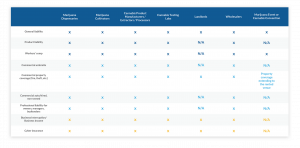

Cannabis insurance is (or should be) as nuanced as the different strains of marijuana itself. Ideally, cannabis-related businesses (CRBs) seek coverage from a partner who has the experience and the market access to deliver a truly customized program. In Massachusetts and New England, C&S Insurance is one of those partners.

Whether you’re applying for a registered marijuana dispensary (RMD) in Massachusetts; selling wholesale, cultivating hemp, processing cannabis flowers, leaves or stalks, this page will provide everything you need to know about Massachusetts cannabis insurance, including the most frequently asked questions we receive on the topic.