How Much Car Insurance Do I Need?

How much car insurance do I need? Great question! The short and easy answer is: probably more than what you have right now…

We’re not saying that just to drum up business. The fact is, too many drivers are lured into lowball car insurance quotes that are based on state minimums. And Massachusetts’ required minimum limits are frighteningly low, when you consider the actual cost of most car accidents (more on this below).

Meanwhile, the difference you would pay for, say, $50,000 in bodily injury coverage versus $500,000 in bodily injury coverage is usually just a few dollars per month (per vehicle). Yes, you read that correctly: roughly $10 to $20 per month for an extra $450,000 worth of coverage.

So why aren’t more drivers better insured against car accidents? Maybe because they aren’t talking to an expert before buying car insurance… Here are the facts:

How much car insurance does Massachusetts require?

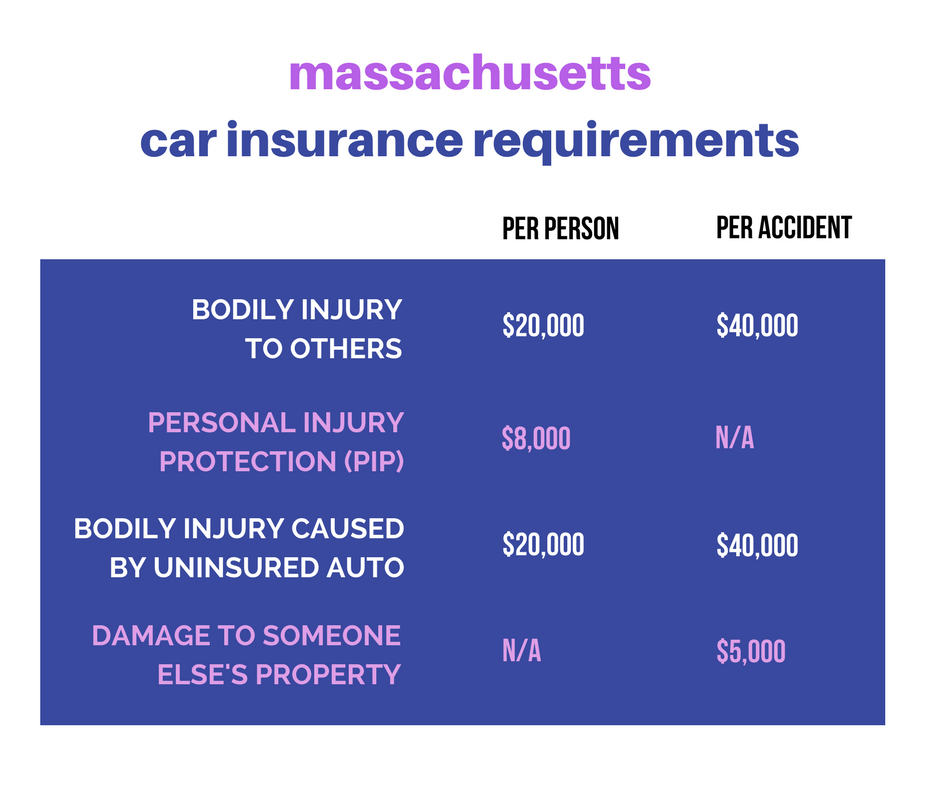

Bay State drivers are required to have four types of MA car insurance at the following minimum levels:

Is the Massachusetts state minimum enough?

In our opinion, no. (And the Commonwealth agrees with us, by the way. The Mass.gov website even states:

“Given the high costs associated with serious accidents, most drivers buy coverage limits beyond the minimum requirements.”

Here are some facts to help put the numbers into perspective:

The average car now costs a little over $31,000. Luxury cars like Mercedes and BMWs cost a good deal more. So if your at-fault collision totals one—and research indicates total loss frequency is trending higher than usual–you’re going to need a whole lot more than $5,000 in property damage coverage.

So how much does a car accident actually cost?

The National Safety Council estimates the following average costs for car accidents. These averages include lost wages, vehicle damage, and medical expenses per injury, not per incident. So depending on how many people are injured or killed in an accident, these costs could be exponentially higher:

• Fatal Accident: $1,500,000

• Disabling Injury: $90,000

• Evident Injury: $26,000

• Possible Injury: $21,000

• No Injury Observed: $11,000

A quick look at the state’s minimums shows that the required bodily injury or PIP wouldn’t come close to covering a disabling injury. Even in accidents where no injuries are observed, the average cost is more than double the required property damage limit.

Other forms of property (besides vehicles) can be expensive, too. Consider the different types of property that a car might collide with: telephone poles, street lamps, guardrails, mailboxes. Some of these can cost up to thousands of dollars in damages all by themselves, because of the replacement material, equipment, and labor involved in a repair. According to storefrontsafety.org, vehicles crash into U.S. storefronts roughly 60 times a day. It’s difficult to assign an average price tag to structural damages to a store, restaurant, or private residence, but one can guess these costs often exceed $5,000 as well.

Do I need collision and comprehensive coverage?

If you look at the chart of Massachusetts’ required coverages, you’ll notice that none of the categories listed apply to your car or truck. That’s where comprehensive and collision coverages come into play. Comprehensive/collision are optional additions you can (and should) add to your MA car insurance policy to cover the cost of damage to your vehicle.

Collision, as the name would suggest, covers you for damage sustained in a collision event. With collision coverage, your policy would pay for damages up to the actual cash value of the vehicle, minus the deductible that you select (which you would need to pay out of pocket). Notice the term “actual cash value,” which is often different from the amount car owners owe on their vehicles. If you have a loan on your car, you may want to consider gap coverage, so you aren’t stuck making up the difference if your financed car is totaled.

Comprehensive covers many other causes of damage—damage that is not related to a collision. For example, comprehensive coverage typically covers damage caused by falling objects (tree limbs, acorns), road debris that cracks your windshield, animal encounters, domestic disputes (e.g. Carrie Underwood taking a Louisville Slugger to both headlights), vandalism, theft, and fire. That last one is important to keep in mind; don’t assume that your home or renter’s policy would cover car damage if the garage ever caught on fire; it probably wouldn’t.

Can you tell me how much car insurance I should have?

Yes! We would love to. Call our expert team at 508.339.2951. We’ll take the time to review your current coverage along with what you’re paying versus what we recommend. We can explain key issues that affect teen driving and explain who qualifies for accident forgiveness. We’ll also shop our many different insurance carriers to find you the most competitive rate.

What if I’m a very careful driver? Do I still need car insurance coverage beyond the state minimums?

Even if you follow every traffic law and obey every speed limit, there are still plenty of careless/distracted/substance-impaired drivers on the road. And many of them don’t have enough insurance—or any insurance at all.

Make sure you and your family members are adequately covered. Give us a call or fill out the quick quote form today.